Introduction

Whether you’re running a peer-to-peer rental platform, a service marketplace, or a product-based marketplace, your legal responsibilities extend beyond local borders. Data privacy laws, payment regulations, user verification, tax obligations, and consumer protection rules are all part of the intricate web you must manage.

Successful marketplace owners implement ongoing compliance assessments, adopt robust data security practices, integrate compliant payment solutions, and maintain transparent policies from day one.

In this article, we’ll break down the most critical legal and compliance considerations for global Sharetribe marketplaces, including GDPR, PSD2, KYC/AML, tax regulations, and more. Whether you’re just launching or scaling internationally, this guide will help you navigate the regulatory landscape with confidence.

Why is Legal Compliance Important?

Legal compliance is critical for any online marketplace because it builds the foundation of trust, security, and long-term sustainability. Operating without compliance exposes your platform to legal penalties, fines, or even forced shutdowns by regulatory authorities. More importantly, in today’s privacy-conscious and security-focused digital environment, users expect platforms to safeguard their personal data, handle payments securely, and prevent fraud. Compliance with regulations like GDPR, PSD2, and KYC not only protects your users but also protects your brand reputation.

It signals that your marketplace is professional, reliable, and committed to ethical operations—qualities that are essential for attracting vendors, customers, and investors alike. In short, legal compliance isn’t just about avoiding risks—it’s a strategic business necessity.

What are the key regulations and their implications?

1. GDPR & Data Privacy Compliance: Protecting User Information Globally

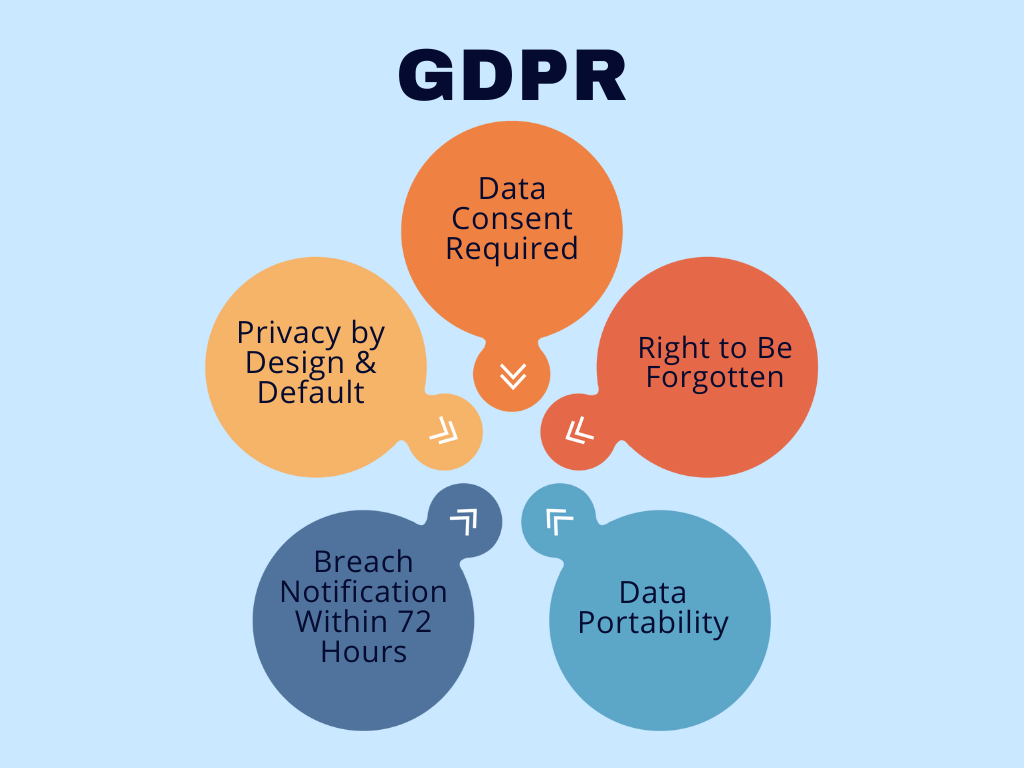

The General Data Protection Regulation (GDPR) is one of the most comprehensive data privacy laws in the world. It applies to any platform that collects or processes personal data from European Union (EU) or European Economic Area (EEA) citizens—regardless of where the business is physically located. For global Sharetribe marketplace owners, this means that if even one of your users is based in Europe, your platform must comply with GDPR.

One of the core principles of GDPR is informed consent. Users must clearly understand what data is being collected, why it’s being collected, how it will be used, and who it will be shared with. This requires transparent privacy policies, consent checkboxes during sign-up, and cookie consent banners on your website. Pre-ticked boxes or hidden terms are not compliant under GDPR.

Data Access and ControlGDPR gives users specific rights over their personal data, often referred to as Data Subject Rights. These include the right to access their data, correct inaccuracies, download their information, or request deletion (the “right to be forgotten”). As a marketplace owner, you need to have systems in place to respond to these requests promptly—usually within 30 days.

Under GDPR, you must follow the principle of data minimization—only collect data that is necessary for your Sharetribe marketplace to function. For example, if you’re running a rental marketplace, you might need the user’s name, location, and payment details, but collecting unrelated personal data could violate GDPR. You also cannot use the collected data for any purpose other than what was explicitly disclosed during collection.

Secure Data Storage and ProtectionProtecting personal data from unauthorized access, breaches, or leaks is another critical GDPR requirement. This means using secure servers, encrypted storage, SSL certificates, and regular security audits. If your marketplace suffers a data breach, you are required to notify both the affected users and the regulatory authorities—usually within 72 hours.

Most Sharetribe marketplaces rely on third-party services like Stripe for payments, Mailchimp for emails, or Google Analytics for tracking. Each of these tools may process user data, so you are responsible for ensuring they are also GDPR-compliant. Sharetribe provides baseline support for GDPR through its data management features, but it’s your responsibility to verify that all integrations and customizations meet privacy standards.

Marketplace Reputation and TrustBeyond legal obligations, complying with GDPR builds trust with your users. Data privacy has become a top concern for consumers worldwide, and marketplaces that demonstrate transparency and respect for user information stand out from the competition. By prioritizing GDPR compliance, you’re not just avoiding penalties—you’re creating a safer, more trustworthy user experience.

2. PSD2 & Payment Regulations: Ensuring Secure and Compliant Transactions

If your marketplace operates in the European Economic Area (EEA) or serves customers and providers from the EU, you must comply with the Payment Services Directive 2 (PSD2). This regulation is designed to make online payments more secure, promote innovation in financial services, and reduce the risk of fraud in digital transactions. For marketplace owners, understanding and implementing PSD2-compliant payment flows is essential for both legal compliance and customer trust.

One of the key components of PSD2 is Strong Customer Authentication (SCA). This means that certain transactions—especially those involving significant amounts—must go through two-factor authentication (2FA). For example, a user may need to verify their payment using a password and a one-time code sent to their phone, or via biometric authentication such as fingerprint or facial recognition. This adds a vital layer of security, protecting both buyers and sellers from unauthorized transactions.

PSD2 mandates secure, API-driven payment processing with end-to-end encryption. This ensures that sensitive financial data, such as credit card details or bank account information, is not exposed during transactions. Using a reliable and compliant payment gateway is critical for marketplace operators. Sharetribe’s native integration with Stripe Connect provides a secure way to process payments, but platform owners must ensure the setup is properly configured to meet PSD2 guidelines, especially when dealing with high-risk transactions.

Payment Intermediary Rules and LicensingA major concern for marketplace operators is whether your platform is considered a payment intermediary. If your marketplace collects payments on behalf of sellers and holds funds before distributing them, PSD2 may require you to obtain a payment institution license—a process that is often costly and time-consuming.

However, by using a licensed third-party payment provider like Stripe Connect, you can avoid this complexity. Stripe handles the regulatory burden by managing funds transfers directly between buyers, sellers, and the platform. This simplifies compliance and reduces legal risks for marketplace owners.

Sharetribe’s Stripe Connect integration is designed with PSD2 compliance in mind. Stripe Connect takes care of SCA, encryption, and direct payouts to vendors, minimizing the need for marketplace operators to handle sensitive financial data. This approach ensures that funds are automatically routed to the right parties, and the marketplace operator can collect commissions transparently.

If you choose to customize your Sharetribe marketplace and integrate additional payment solutions beyond Stripe, it’s your responsibility to ensure these services are also PSD2-compliant. This may involve verifying that the provider supports SCA, uses secure APIs, and meets the regulatory standards set by EU financial authorities.

3. KYC & AML: Know Your Customer & Anti-Money Laundering Compliance

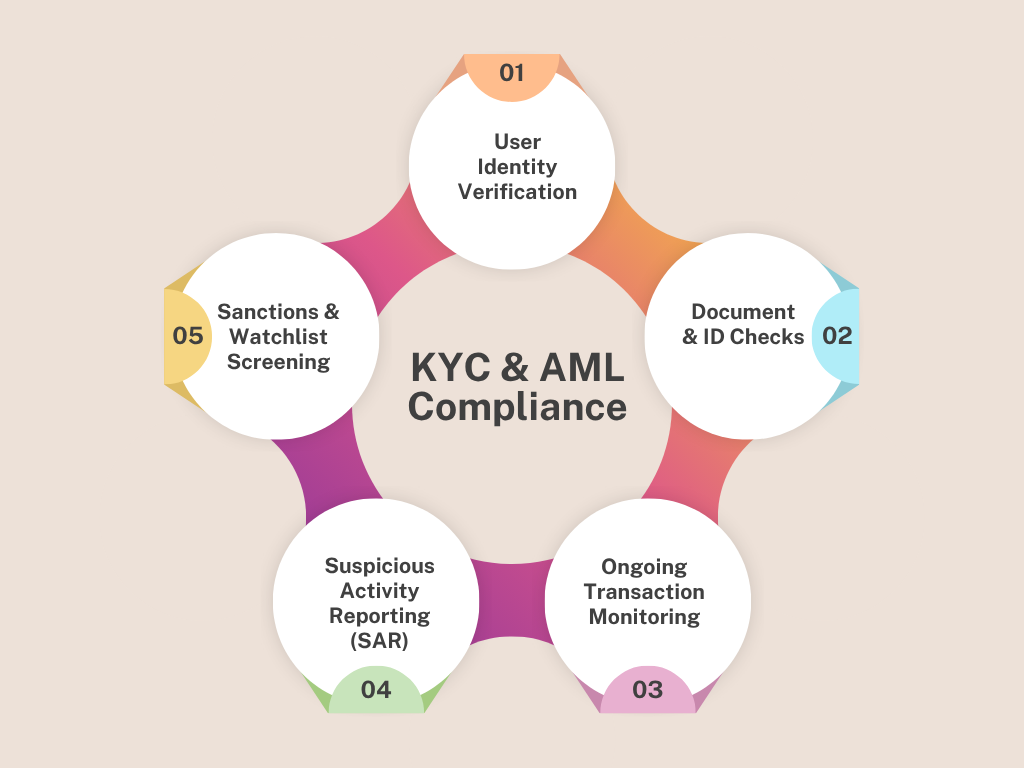

When operating a marketplace that processes financial transactions, especially in industries such as rentals, peer-to-peer services, or high-value product exchanges, you may be subject to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. These regulations are designed to prevent marketplaces from being used for illegal activities, such as money laundering, tax evasion, or fraudulent transactions.

KYC is a critical step in verifying the identities of your users—particularly sellers, providers, or vendors—before allowing them to operate on your platform. By confirming the legitimacy of marketplace participants, you help prevent bad actors from exploiting your platform for illicit purposes. This verification process also helps protect honest users by reducing the risk of scams or fraudulent behavior.

Document Collection and Identity Verification

The KYC process often involves collecting government-issued IDs, tax documents, business licenses, and bank account information from sellers and providers. Depending on your marketplace model, you may also need to verify buyers, especially if they are engaging in high-risk or large financial transactions. Collecting these documents securely and managing the verification process is a key compliance requirement, and mishandling this data could lead to privacy breaches or legal penalties (also tying back to GDPR compliance).

Ongoing Monitoring and Compliance Updates

KYC is not a one-time task. Ongoing monitoring is required to ensure that user information remains accurate and up-to-date. For example, a vendor may need to re-submit identification documents if they expire, or undergo additional verification if suspicious activity is detected. AML compliance also requires monitoring transactions for red flags, such as unusual payment patterns or large cash movements that could indicate money laundering.

How Sharetribe Handles KYC & AML?

Sharetribe does not directly manage KYC or AML compliance within its core platform, but this is handled effectively through its integration with Stripe Connect. Stripe’s onboarding process includes automated identity verification, bank account linkage, and real-time fraud monitoring. This significantly reduces the compliance burden for Sharetribe marketplace operators, as Stripe assumes responsibility for much of the regulatory work required to meet financial laws.

Additional Solutions for Custom Marketplaces

If you decide to build custom payment solutions or use alternative payment providers beyond Stripe, you’ll need to partner with licensed KYC/AML service providers such as Sumsub, Onfido, or Jumio. These services offer robust user verification systems, including AI-driven ID checks, facial recognition, and document validation to ensure compliance.

Moreover, you must ensure secure storage and management of sensitive personal data, fully aligning with data privacy regulations like GDPR. This involves using encrypted databases, restricting access to sensitive information, and having clear policies for data retention and deletion.

4. Tax Compliance: VAT, Sales Tax, and Marketplace Liability

Running an international marketplace isn’t just about connecting buyers and sellers—it also involves complying with a complex web of tax regulations. From Value Added Tax (VAT) to sales tax and digital goods taxation, marketplace operators need to understand their financial responsibilities to avoid costly legal consequences.

VAT is a consumption tax applied to goods and services in many countries, particularly in the European Union. If your marketplace sells digital services, rentals, or physical products to customers in VAT-eligible regions, you may be required to collect and remit VAT, even if your business is located outside the EU. This obligation applies to both B2C (business-to-consumer) and, in some cases, B2B (business-to-business) transactions.

For example, if your Sharetribe marketplace facilitates online language lessons, vacation rentals, or event bookings for EU customers, VAT regulations may require you to include VAT in your pricing and handle the payment of that tax to the relevant government agencies.

In recent years, many governments have shifted the tax collection responsibility to online marketplaces themselves. This means that, in some regions—such as the EU and various US states—marketplaces are considered the “deemed seller” for tax purposes, making them directly liable for collecting and remitting sales tax or VAT on behalf of vendors.

This approach simplifies tax enforcement for governments but increases compliance obligations for marketplace owners. You must ensure your platform can accurately calculate taxes based on the customer’s location, the type of product or service, and the local tax rates. Failing to do this can lead to significant penalties or back taxes.

Digital Goods and Services TaxationEven if your marketplace only deals with digital products or online services, you are not exempt from taxation. Many countries have introduced specific digital services taxes (DST) or have extended VAT laws to cover digital transactions. For example, streaming services, online courses, virtual consulting, and downloadable products may all be subject to tax in multiple jurisdictions. As your marketplace scales internationally, staying on top of these evolving rules is crucial.

Sharetribe’s Approach to Taxation

Sharetribe offers flexibility in handling taxes through its customizable transaction process. You can add commission fees, service charges, and basic tax calculations during checkout, but VAT or regional sales tax handling often requires additional customization. Sharetribe does not automatically calculate varying tax rates based on buyer location, so you may need to develop custom workflows or integrations.

Stripe Tax Integration

For marketplaces using Stripe Connect, Stripe Tax is a powerful solution that automates the collection of VAT, GST, and sales taxes across different regions. Stripe Tax can:

-

Automatically detect the customer’s location.

-

Apply the correct tax rates.

-

Generate detailed tax reports to simplify filings.

This seamless integration can significantly reduce the complexity of tax compliance for Sharetribe marketplace operators.

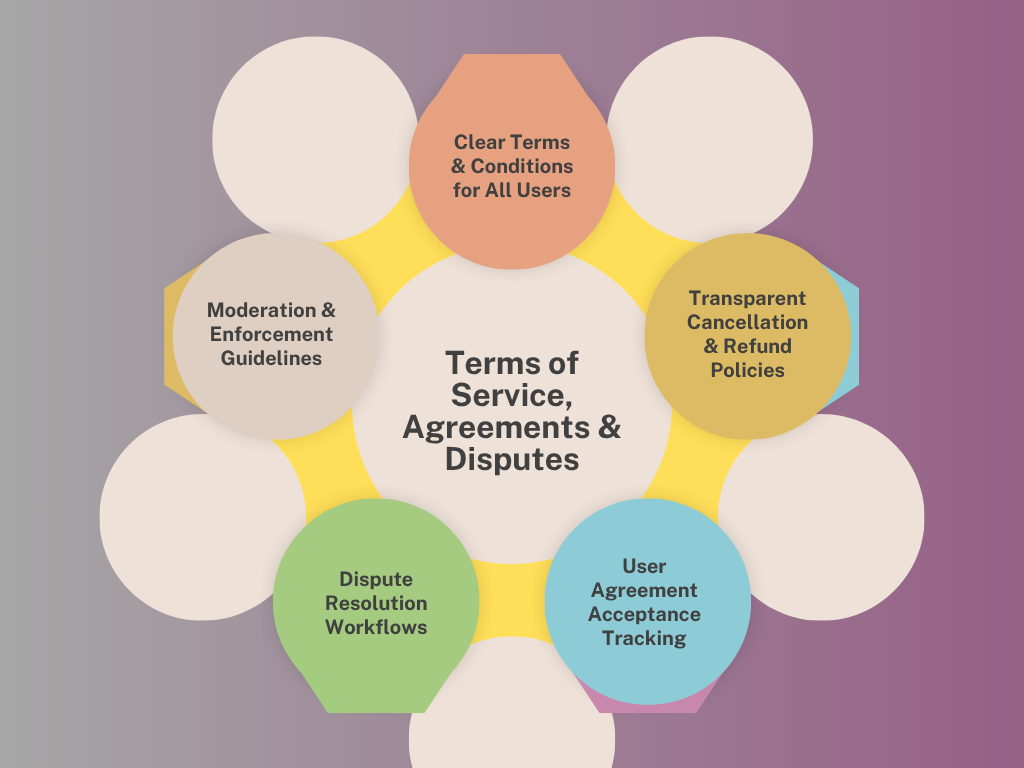

5. Terms of Service, User Agreements & Dispute Management

Your Terms of Service (ToS), Privacy Policy, and Vendor Agreements are the legal backbone of your marketplace. These documents outline the rules for how users interact on your platform, set expectations, and protect you from unnecessary liability. Without clear legal agreements, misunderstandings can quickly escalate into legal disputes that damage your reputation and business.

The Terms of Service clearly define the roles and responsibilities of both buyers and sellers. This includes guidelines on appropriate conduct, prohibited activities, payment terms, and the consequences of policy violations. It’s important to set these rules in plain, accessible language so that users understand their obligations before using your marketplace.

Limiting Platform LiabilityA well-written ToS also helps limit your liability as a platform owner. Since Sharetribe marketplaces typically act as intermediaries between buyers and sellers, you need to clarify that you are not directly responsible for the quality of the goods or services offered. This helps protect your business in cases of disputes between users or if a transaction goes wrong.

Dispute management is another critical area. Your marketplace should have clear workflows for handling user complaints, cancellations, refunds, and disputes. Sharetribe allows you to customize the transaction process, making it easier to incorporate refund policies or cancellation windows directly into the booking and payment flow. Providing a structured dispute resolution process helps resolve conflicts fairly and minimizes reputational damage.

Custom Legal AgreementsAvoid using generic templates for your ToS and Privacy Policy. Each marketplace is unique, and your agreements should reflect the specific nature of your platform, your business model, and the regulations of the regions you serve. Consult with a legal expert to draft agreements that are tailored to your marketplace’s structure and services.

Lastly, always specify the legal jurisdiction and governing law in your agreements. For example, clarify whether disputes will be resolved under the laws of the EU, the US, or your local country. This helps prevent confusion in case of legal claims and ensures that disputes are handled in a predictable legal environment.

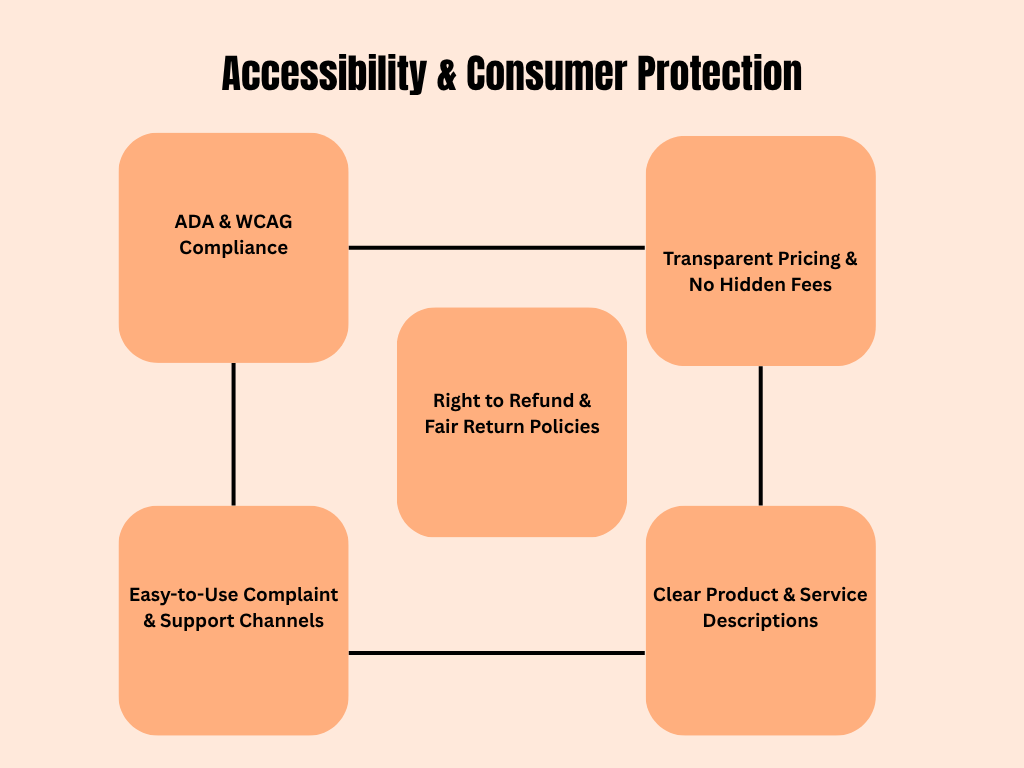

6. Accessibility & Consumer Protection Laws

Compliance goes beyond financial regulations and data privacy. As a global marketplace operator, you must also adhere to consumer protection laws and digital accessibility standards to create a fair and inclusive environment.

Right to Refunds or CancellationsDifferent regions have varying consumer protection laws regarding refunds, cancellations, and product returns. For instance, in the EU, consumers have the right to cancel online purchases within a 14-day window in many cases. Your marketplace policies must reflect these legal obligations depending on the location of your users and the types of services or products you offer. Failing to comply could result in legal disputes or fines from consumer protection agencies.

Your marketplace must be accessible to individuals with disabilities, following standards like the Web Content Accessibility Guidelines (WCAG). Accessibility includes features such as text alternatives for images, proper color contrast, keyboard navigation, and compatibility with screen readers. Making your platform accessible is not just a legal requirement in many countries—it also expands your user base and demonstrates a commitment to inclusivity.

Transparency is key to building trust with your users. You must clearly display all costs, including commissions, service fees, taxes, or additional charges, before checkout. Many consumer protection laws prohibit deceptive practices like hidden fees or misleading pricing. By openly communicating pricing structures, you create a positive user experience and reduce the likelihood of customer complaints or chargebacks.

Conclusion

Navigating legal and compliance requirements is essential for running a successful global Sharetribe marketplace. From data privacy and secure payments to tax obligations and consumer protection, each area plays a crucial role in building trust and ensuring long-term growth.

By proactively addressing GDPR, PSD2, KYC/AML, tax compliance, user agreements, and accessibility, you not only reduce legal risks but also create a safer, more transparent, and user-friendly marketplace.

FAQ's

Q1. Is Sharetribe fully compliant with GDPR and PSD2 by default?

Sharetribe provides the tools to comply, but you must configure your platform, policies, and third-party services correctly to ensure full compliance.

Q2. Do I need a lawyer to launch a Sharetribe marketplace globally?

It’s recommended. An experienced legal advisor can help you draft terms, manage compliance, and navigate specific regulations in your target markets.

Q3. Can I handle KYC without using Stripe Connect?

Yes, but you’ll need to integrate third-party KYC services like Onfido, Sumsub, or Jumio and manage the process securely.

Q4. How do I calculate VAT for my marketplace?

Use Stripe Tax or a service like Avalara to automate VAT calculations and remittance, especially if you operate across multiple countries.

Q5. What happens if I ignore compliance requirements?

Non-compliance can lead to fines, legal disputes, platform shutdowns, or loss of user trust. It’s better to address compliance early in your marketplace journey.